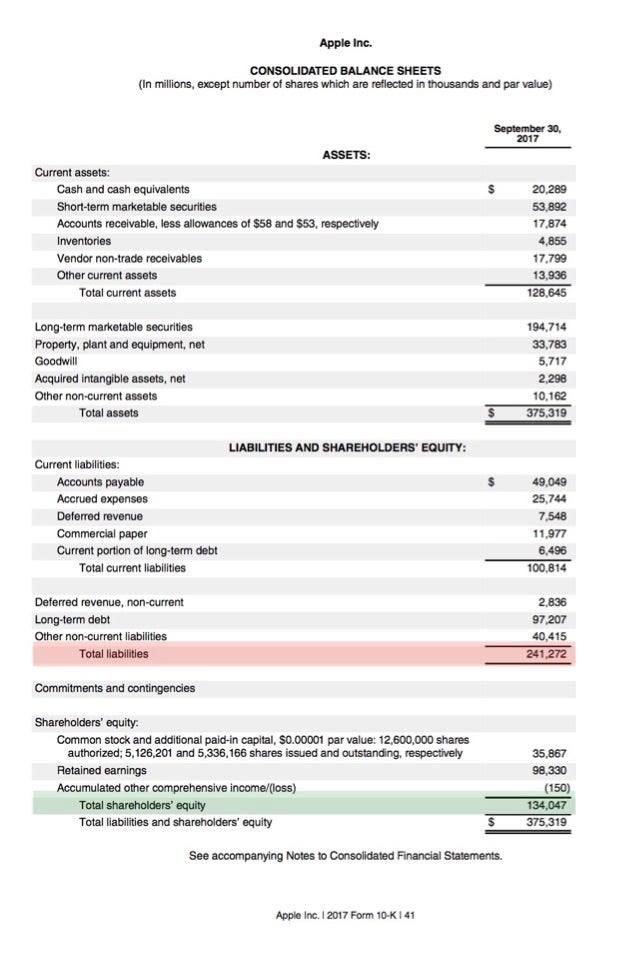

To calculate the current ratio, divide the company’s current assets by its current liabilities. Current assets are those that can be converted into cash within one year, while current liabilities are obligations expected to be paid within one year. Examples of current liabilities include accounts payable, wages payable, and the current portion of any scheduled interest or principal payments. Both current assets and current liabilities are listed on a company’s balance sheet. The current ratio is a financial liquidity ratio that is most commonly used to measure a company’s ability to meet its short term debt obligations. The higher of a current ratio that a company has then generally speaking the easier it is for them to pay their short term debt obligations.

Here, the company could withstand a liquidity shortfall if providers of debt financing see the core operations are intact and still capable of generating consistent cash flows at high margins. The range used to gauge the financial health of a company using the current ratio metric varies on the specific industry. Let’s be honest – sometimes the best current ratio calculator is the one that is easy to use and doesn’t require us to even know what the current ratio formula is in the first place! But if you want to know the exact formula for calculating current ratio then please check out the “Formula” box above. Like most performance measures, it should be taken along with other factors for well-contextualized decision-making. In the first case, the trend of the current ratio over time would be expected to harm the company’s valuation.

Current ratios over 1.00 indicate that a company’s current assets are greater than its current liabilities, meaning it could more easily pay of short-term debts. The formula to calculate the current ratio divides a company’s current assets by its current liabilities. To measure solvency, which is the ability of a business to repay long-term debt and obligations, consider the debt-to-equity ratio. It measures how much creditors have provided in financing a company compared to shareholders and is used by investors as a measure of stability. Simply add the total current assets and current liabilities and get the current ratio within seconds through this current ratio calculator.

If the inventory is unable to be sold, the current ratio may still look acceptable at one point in time, even though the company may be headed for default. The current ratio is called current because, unlike some other liquidity ratios, it incorporates all current assets and current liabilities. In comparison to the current ratio, the quick ratio is considered a more strict variation due to filtering out current assets that are not actually liquid — i.e. cannot be sold for cash immediately. Tracking the current ratio can be viewed as “worst-case” scenario planning (i.e. liquidation scenario) — albeit, the company’s business model may just require fewer current assets and comparatively more current liabilities.

How We Make Money

To calculate the ratio, analysts compare a company’s current assets to its current liabilities. However, because the current ratio at any one time is just a snapshot, it is usually not a complete representation of a company’s short-term liquidity or longer-term solvency. The current ratio of 1.0x is right on the cusp of an acceptable value, since if the ratio dips below 1.0x, that means the company’s current assets cannot cover its current liabilities. As another example, large retailers often negotiate much longer-than-average payment terms with their suppliers. If a retailer doesn’t offer credit to its customers, this can show on its balance sheet as a high payables cost accounting vs retail accounting balance relative to its receivables balance. Large retailers can also minimize their inventory volume through an efficient supply chain, which makes their current assets shrink against current liabilities, resulting in a lower current ratio.

Editorial integrity

In this example, Company A has much more inventory than Company B, which will be harder to turn into cash in the short term. Perhaps this inventory is overstocked or unwanted, which eventually may reduce its value on the balance sheet. Company B has more cash, which is the most liquid asset, and more accounts receivable, which could be collected more quickly than liquidating inventory.

The Bankrate promise

Changes in the current ratio over time can often offer a clearer picture of a company’s finances. A company that seems to have an acceptable current ratio could be trending toward a situation in which it will struggle to pay its bills. Conversely, a company that may appear to be struggling now could be making good progress toward a healthier current ratio.

Suppose we’re tasked with analyzing the liquidity of a company with the following balance sheet data in Year 1. As a general rule of thumb, a current ratio in the range of 1.5 to 3.0 is considered healthy. For the last step, we’ll divide the current assets by the current liabilities. The Current Ratio is a measure of a company’s near-term liquidity position, or more specifically, the short-term obligations coming due within one year. Simply follow a couple of straightforward steps to perform the current ratio calculation with our financial ratio calculator. The current Ratio is one of the most vital calculations that lets you calculate the ability of a company to pay off its debts.

If a company’s current ratio is less than one, it may have more bills to pay than easily accessible resources to pay those bills. In its Q fiscal results, Apple Inc. reported total current assets of $135.4 billion, slightly higher than its total current assets at the end of the 2021 fiscal year of $134.8 billion. However, the company’s liability composition significantly changed from 2021 to 2022. At the end of 2022, the company reported $154.0 billion of current liabilities, almost $29 billion greater than current liabilities from 2021.

Another practical measure of a company’s liquidity is the quick ratio, otherwise known as the “acid-test” ratio. The current ratio reflects a company’s capacity to pay off all its short-term obligations, under the hypothetical scenario that short-term obligations are due right now. The current ratio is most useful when measured over time, compared against a competitor, or compared against a benchmark. If all current liabilities of Apple had been immediately due at the end of 2021, the company could have paid all of its bills without leveraging long-term assets. This is markedly different from Company B’s current ratio, which demonstrates a higher level of volatility. This could indicate increased operational risk and a likely drag on the company’s value.

For example, a financially healthy company could have an expensive one-time project that requires outlays of cash, say for emergency building improvements. Because buildings aren’t considered current assets, and the project ate through cash reserves, the current ratio could fall below 1.00 until more cash is earned. Company A has more accounts payable, while Company B has a greater amount in short-term notes payable. This would be worth more investigation because it is likely that the accounts payable will have to be paid before the entire balance of the notes-payable account. Company A also has fewer wages payable, which is the liability most likely to be paid in the short term. In this example, the trend for Company B is negative, meaning the current ratio is decreasing over time.

If you want to save time then get the assistance of the online current ratio formula calculator because it will let you perform the current ratio accounting in a matter of seconds. This could indicate that the company has better collections, faster inventory turnover, or simply a better ability to pay down its debt. The trend is also more stable, with all the values being relatively close together and no sudden jumps or increases from year to year. An investor or analyst looking at this trend over time would conclude that the company’s finances are likely more stable, too. Note the growing A/R balance and inventory balance require further diligence, as the A/R growth could be from the inability to collect cash payments from credit sales.

- Examples of current liabilities include accounts payable, wages payable, and the current portion of any scheduled interest or principal payments.

- In this scenario, the company would have a current ratio of 1.5, calculated by dividing its current assets ($150,000) by its current liabilities ($100,000).

- Presently, she is the senior investing editor at Bankrate, leading the team’s coverage of all things investments and retirement.

- The company has just enough current assets to pay off its liabilities on its balance sheet.

- To calculate the current ratio, divide the company’s current assets by its current liabilities.

- An analyst or investor seeing these numbers would need to investigate further to see what is causing the negative trend.

Apple technically did not have enough current assets on hand to pay all of its short-term bills. A current ratio of less than 1.00 may seem alarming, but a single ratio doesn’t always export xero to google sheets and other formats offer a complete picture of a company’s finances. The limitations of the current ratio – which must be understood to properly use the financial metric – are as follows. Often, the current ratio tends to also be a useful proxy for how efficient the company is at working capital management. The best long-term investments manage their cash effectively, meaning they keep the right amount of cash on hand for the needs of the business. Mercedes Barba is a seasoned editorial leader and video producer, with an Emmy nomination to her credit.

But a too-high current ratio may indicate that a company is not investing effectively, leaving too much unused cash on its balance sheet. Companies may use days sales outstanding to better understand how long it takes for a company to collect payments after credit sales have been made. While the current ratio looks at the liquidity of the company overall, the days sales outstanding metric calculates liquidity specifically to how well a company collects outstanding accounts receivables. For example, a company may have a very high current ratio, but its accounts receivable may be very aged, perhaps because its customers pay slowly, which may be hidden in the current ratio. Analysts also must consider the quality of a company’s other assets vs. its obligations.

This is why it is helpful to compare a company’s current ratio to those of similarly-sized businesses within the same industry. The current ratio measures a company’s ability to pay current, or short-term, liabilities (debts and payables) with its current, or short-term, assets, such as cash, inventory, and receivables. With the help of this current ratio calculator, you can quickly evaluate the financial health of your business by measuring its ability to meet the liabilities (debts or obligations) when they become due. Ratios in this range indicate that the company has enough current assets to cover its debts, with some wiggle room. A current ratio lower than the industry average could mean the company is at risk for default, and in general, is a riskier investment. For example, a company’s current ratio may appear to be good, when in fact it has fallen over time, indicating a deteriorating financial condition.