How to Calculate Burn Rate: A Comprehensive Guide for Startups

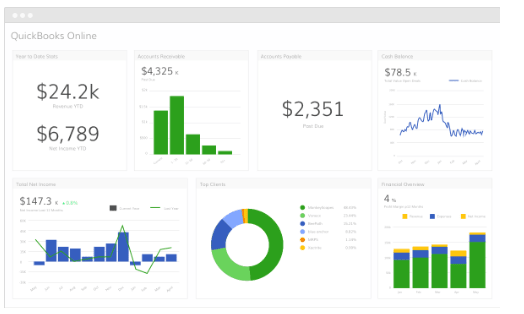

Using the above example, your operational expenses for the month totaled $5,500. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. Your run rate, on the other hand, uses current financial information to forecast your financial performance. It assumes that your current financial information will stay consistent when predicting future performance. Read testimonials and reviews from our customers who have achieved their goals with Baremetrics. Discover how Stripe Analytics stacks up against Baremetrics in terms of features, ease of use, and overall benefits.

How to calculate gross burn rate

That could indicate no affirmative action was taken to manage spending, increase profitability, or lower expenses. However, that doesn’t mean you don’t try to take calculated business risks through advertising and marketing, new product launches, or testing out different companies to handle manufacturing. A reasonable risk is better than sitting on your hands all day waiting for the “master” to return. A high burn rate indicates that a company is spending too much money too fast and could enter a state of financial distress.

How to Calculate Burn Rate & Cash Runway

A company’s gross burn is the total amount it’s spending on operational expenses each month (with the absence of positive cash flow). In our example above, a startup spending $30,000 a month on staff salaries, office space, and a cool new ping pong table would have a gross burn rate of $30,000 per month. In financial modeling, the burn rate is used to track the amount of monthly cash that a company spends before it starts generating its own income.

Join 41,000+ Fellow Sales Professionals

- A company can look at these monthly numbers and determine whether their company is sustainable if they keep operating under the same conditions.

- There is no specific figure for a good burn rate because spend and revenue vary drastically from business to business.

- A positive cash flow signifies that a company is generating more revenue than its expenses during a given period.

- Burn rates are typically calculated on a monthly basis because it gives a more accurate picture of the current drains on your budget.

- Although, your CFO should focus on resolving this issue by exploring potential funding options to ensure you do not run out of money.

- You just need a firm grasp on how you spend your money and you’re good to go.

Its cash balance on March 31, the last day of the quarter, is $100,000. This mainly depends on the specifics of your business, and how aggressively your business strategy has prioritised growth over the short to medium term. If you’ve heard the phrase “burning cash,” then you likely already understand what burn rate means. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Recall the gross rate variation takes into account solely the cash losses.

Finance ,Banking & Compliance Made Easy for Startups

- Instead, you might want to use a strategy or two to take control rather than overhaul your financial plan.

- First, don’t underestimate what you can do in a year or overestimate what you can do in five years.

- As we mentioned before, you can calculate your burn rate over different time periods.

- However, it’s worth noting that some industries have inherently high operating costs and may require a higher burn rate for growth.

- Burn rate is a financial term that illustrates the speed at which a company exhausts its cash reserves or cash balance over a given period (usually measured on a monthly basis).

Another consequence of a mismanaged burn rate is that a company may find itself unprofitable for an extended period of time. This can affect investor confidence and make it difficult for the company to attract new investments. Unprofitability also makes it challenging for a company to cover its operational costs and continue to grow. Keep in mind that burn rates can fluctuate due to changes in monthly expenses, income, or cash injections, so it’s crucial to monitor them regularly. A company’s ability to manage its burn rate effectively is vital for long-term sustainability, as it ensures that sufficient cash is available to cover ongoing expenses and fund future growth.

See a detailed comparison between Baremetrics and Profitwell, including a breakdown of key differences and benefits. Evaluate how Baremetrics compares to ChartMogul in terms of features, usability, and value. Get answers to common questions and learn how to get the most out of Baremetrics. Company X’s burn rate is $20,000/month for the first quarter of the year. Helping Founders and Customer Success Managers handle customer retention effectively.

In venture capital (VC), the burn rate metric measures the time an early-stage company, or start-up, has until its operations can no longer be sustained, creating the necessity to raise funding. From the perspective of a startup, a burn rate can show you your spending habits. A company can look at these monthly numbers and determine whether their company is sustainable if they keep operating under the same conditions. Later on, we will discuss some strategies that could positively affect burn rate. A high burn rate is just a fact of life for many early-stage businesses.

Various financial tools can assist in this process, including burn rate calculators, financial modeling, and valuation. Start building with DigitalOcean today to take the first step towards a more sustainable future for your startup. For example, if your startup has $240,000 in the bank and a net rate of $60,000, your runway is 4 months ($240,000 / $60,000). Continuing with the previous example, if your startup also generated $20,000 in revenue during the month, your net burn rate would be $60,000 ($80,000 in total expenses minus $20,000 in revenue). No matter the maturity of your startup, you need to have a solid grasp on burn rate as a concept. It’s a vital component that will guide how you spend, how you forecast, when you opt to turn to investors, and how you make strategic decisions for your business.

Why Burn Rate is Important for Startups

Burn rate is a vital metric for startups, serving as a thermometer for financial health and operational efficiency. Balancing the burn rate with strategic growth initiatives and prudent financial planning Certified Bookkeeper is key to attracting investment and securing the startup’s future. Burn rate is a term that startups use to describe their cash burn or cash spending.

It’s all about giving you better spend visibility and more ways to control how your money is being spent. Since the pandemic there has been a sharp increase in inflation and a big decrease in the availability of capital for businesses. VC funding and other forms of business capital is much harder to get than it was a few years ago. This means that many businesses have had to find ways to minimise their cash burn and increase their runway in an attempt to weather the storm. Given that your burn rate is the speed at which your business is spending the money in your bank, you’d assume that it’s best to minimise it as much as possible.