Another example is Wayflyer, an Irish-based fintech, which was financed with $300 million by J.P. It’s easy to get started when you open an investment account with SoFi Invest. You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more. SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here).

Debt-To-Equity Ratio: Explanation, Formula, Example Calculations

This indicates that the company is primarily financed through its own resources, reflecting strong financial stability and a lower risk profile. The D/E ratio also gives analysts and investors an idea of how much risk a company is taking on by using debt to finance its operations and growth. Over time, the cost of debt financing is usually lower than the cost of equity financing.

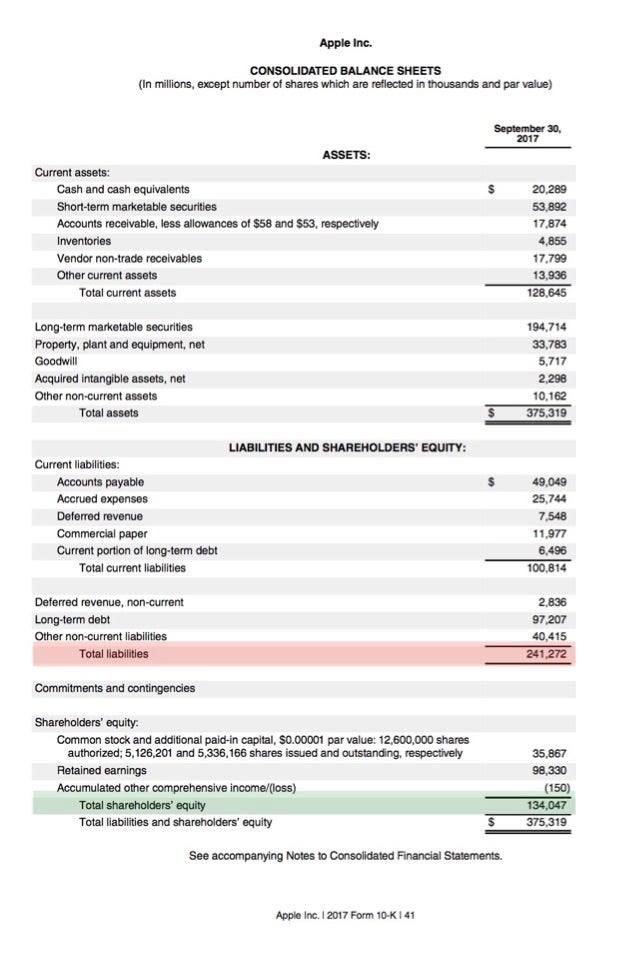

Calculating a Company’s D/E Ratio

The depository industry (banks and lenders) may have high debt-to-equity ratios. Because banks borrow funds to loan money to consumers, financial institutions usually have higher debt-to-equity ratios than other industries. It is possible that the debt-to-equity ratio may be considered too low, as well, which is an indicator that a company is relying too heavily on its own equity to fund operations.

Assets

The ratio offers insights into the company’s debt level, indicating whether it uses more debt or equity to run its operations. The debt-to-equity ratio is one of the most commonly used leverage ratios. The debt-to-equity ratio is calculated by dividing total liabilities by shareholders’ equity or capital. This issue is particularly significant in sectors that rely heavily on preferred stock financing, such as real estate investment trusts (REITs). A company’s debt to equity ratio provides investors with an easy way to gauge the company’s financial health and its capital infrastructure. Making smart financial decisions requires understanding a few key numbers.

- They include long-term notes payable, lines of credit, bonds, deferred tax liabilities, loans, debentures, pension obligations, and so on.

- These balance sheet categories may include items that would not normally be considered debt or equity in the traditional sense of a loan or an asset.

- However, if the additional cost of debt financing outweighs the additional income that it generates, then the share price may drop.

But investors judge leverage ratios differently, depending on the industry sector your company’s in. A higher ratio suggests that debt is being used to finance business growth. IFRS and US GAAP may have some differences in the way of accounting for certain liabilities and assets which could lead to difference in the debt-to-equity ratio calculation. However, the treatment of retained earnings in the calculation of the debt-to-equity ratio is consistent under both IFRS and US GAAP. Both IFRS and GAAP require that retained earnings be included in the denominator of the debt-to-equity ratio. However, it is important to note that sometimes companies have negative equity but are still operating and generating revenue.

A debt-to-equity ratio of between 1 and 1.5 is good for most businesses, but some industries are capital intensive and businesses in these industries traditionally take on more debt. However, a debt-to-equity ratio that is too low suggests the what are the risks of an accounting career company is paying for most of its operations with equity, which is an inefficient way to grow a business. For example, the finance and manufacturing sectors are more capital intensive and so are likely to have debt-to-equity ratios of 2+.

One such critical metric used in financial analysis is the Debt to Equity Ratio. This ratio provides insights into the financial leverage a company possesses and its ability to repay its debts. It is a measure of the proportion of the company’s funding that comes from debt (borrowed money) compared to equity (owners’ investments).

For someone comparing companies in these two industries, it would be impossible to tell which company makes better investment sense by simply looking at both of their debt to equity ratios. Debt to equity ratio also affects how much shareholders earn as part of profit. With low borrowing costs, a high debt to equity ratio can lead to increased dividends, since the company is generating more profits without any increase in shareholder investment.