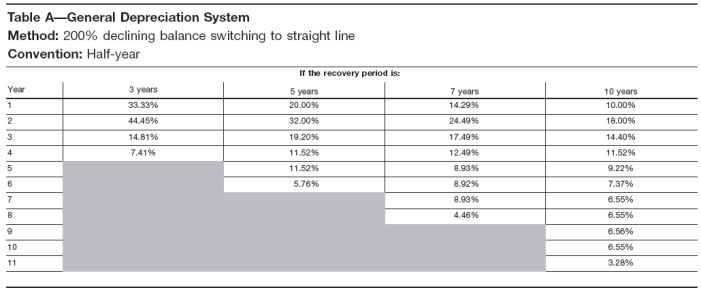

The double declining balance method of depreciation, also known as the 200% declining balance method of depreciation, is a form of accelerated depreciation. This means that compared to the straight-line method, the depreciation expense will be faster in the early years of the asset’s life but slower in the later years. However, the total amount of depreciation expense during the life of the assets will be the same. Accelerated depreciation is any method of depreciation used for accounting or income tax purposes that allows greater depreciation expenses in the early years of the life of an asset. Accelerated depreciation methods, such as double declining balance (DDB), means there will be higher depreciation expenses in the first few years and lower expenses as the asset ages. This is unlike the straight-line depreciation method, which spreads the cost evenly over the life of an asset.

Great! The Financial Professional Will Get Back To You Soon.

The double declining balance (DDB) depreciation method is an accounting approach that involves depreciating certain assets at twice the rate outlined under straight-line depreciation. This results what is considered an adjustment to income in depreciation being the highest in the first year of ownership and declining over time. Depreciation is the process of allocating the cost of a tangible asset over its useful life.

What is the Double Declining Balance Method?

- Various software tools and online calculators can simplify the process of calculating DDB depreciation.

- In the above example, we assumed a depreciation rate equal to twice the straight-line rate.

- Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

- They tend to lose about a third of their value following their initial purchase, and the value falls from there.

- Save more by mixing and matching the bookkeeping, tax, and consultation services you need.

This method is often used for things like machinery or vehicles that lose value quickly at first. To calculate the depreciation expense of subsequent periods, we need to apply the depreciation rate to the laptop’s carrying value at the start of each accounting period of its life. Here’s the depreciation schedule for calculating the double-declining depreciation expense and the asset’s net book value for each accounting period. In case of any confusion, you can refer to the step by step explanation of the process below. First-year depreciation expense is calculated by multiplying the asset’s full cost by the annual rate of depreciation and time factor.

Advantages of the Declining Balance Method

These tools can quickly adjust book values, generate detailed financial reports, and adapt to various depreciation methods as needed. A double-declining balance method is a form of an accelerated depreciation method in which the asset value is depreciated at twice the rate it is done in the straight-line method. Since the depreciation is done at a faster rate (twice, to be precise) than the straight-line method, it is called accelerated depreciation. The depreciation expense recorded under the double declining method is calculated by multiplying the accelerated rate, 36.0% by the beginning PP&E balance in each period.

Fixed Asset Assumptions

Businesses use the double declining balance method when an asset loses its value quickly. This method, like other accelerated depreciation methods, counts depreciation expenses faster. In basic terms, this means that the depreciation schedule sees larger losses in a shorter period of time.

How confident are you in your long term financial plan?

We empower accounting teams to work more efficiently, accurately, and collaboratively, enabling them to add greater value to their organizations’ accounting processes. In year 5, companies often switch to straight-line depreciation and debit Depreciation Expense and credit Accumulated Depreciation for $6,827 ($40,960/6 years) in each of the six remaining years. At the beginning of the first year, the fixture’s book value is $100,000 since the fixtures have not yet had any depreciation. Therefore, under the double declining balance method the $100,000 of book value will be multiplied by 20% and will result in $20,000 of depreciation for Year 1. The journal entry will be a debit of $20,000 to Depreciation Expense and a credit of $20,000 to Accumulated Depreciation.

This makes it ideal for assets that typically lose the most value during the first years of ownership. Unlike other depreciation methods, it’s not too challenging to implement. The best way to explain the double-declining method of depreciation is to look at some simple examples.

When you use Taxfyle, you’re guaranteed an affordable, licensed Professional. Taxfyle connects you to a licensed CPA or EA who can take time-consuming bookkeeping work off your hands. You can connect with a licensed CPA or EA who can file your business tax returns.